How to Calculate Market Size for Your Startup (Free Calculator) 2026

Calculate your startup's TAM, SAM, and SOM in minutes. Free market size calculator + step-by-step framework used by 300+ founders in 2026.

"The market is huge."

Every pitch deck says it. Most are wrong.

I've watched investors sit through hundreds of market slides. The $10B TAM claims blur together. What makes them lean in: a founder who can explain exactly where their number came from, and why it's the slice they can actually win.

Market size isn't about impressing anyone. It's about being honest with yourself first, then having the receipts when someone asks.

Here's how to calculate yours without buying a $2,000 Gartner report or spending a week in spreadsheets.

What is Market Size? (TAM, SAM, SOM Explained)

Market size breaks into three layers. Each answers a different question.

TAM (Total Addressable Market)

Everyone who could theoretically buy your product if you had unlimited resources and zero competition.

Example: "All businesses that need project management software" = ~$10B globally

SAM (Serviceable Addressable Market)

The portion of TAM you can actually reach with your current business model, geography, and go-to-market.

Example: "SMBs in the US using cloud-based tools" = ~$2B

SOM (Serviceable Obtainable Market)

The realistic slice you can capture in the next 1-3 years given your resources, team, and competition.

Example: "SMBs in the US willing to switch from Asana to a cheaper alternative" = ~$50M

TAM > SAM > SOM

$10B > $2B > $50M

Investors care most about SOM. TAM is context. SOM is what you're actually fighting for.

Why Most Market Size Calculations Are Wrong

Three common mistakes kill credibility:

Mistake 1: Top-down fantasy

"The global SaaS market is $200B. If we get 0.1%, that's $200M."

This is not analysis. This is wishful math. You can't work backwards from a giant number and call it a market size.

Mistake 2: Ignoring competition

Your SAM isn't "everyone who needs X." It's "everyone who needs X AND would choose you over existing alternatives."

If Notion, Asana, and Monday own 80% of your target segment, your real SAM is the remaining 20%.

Mistake 3: Confusing TAM with opportunity

A $50B TAM means nothing if your SOM is $5M. Investors know this. They'll ask: "What can you actually capture?"

How to Calculate Market Size (Step-by-Step)

Method 1: Bottom-Up (Recommended)

Start with your customer, not the industry.

Step 1: Define your ideal customer

Be specific. Not "businesses" but "B2B SaaS companies with 10-50 employees in the US."

Step 2: Count them

Use LinkedIn Sales Navigator, industry reports, or government data.

Example: 47,000 B2B SaaS companies with 10-50 employees in the US (source: Census Bureau + Crunchbase estimate)

Step 3: Multiply by your price

47,000 companies x $99/month x 12 months = $55.8M

That's your SOM. Realistic. Defensible. Credible.

Step 4: Work up to SAM and TAM

SOM: $55.8M (US, 10-50 employees, your price)

SAM: $280M (US, all company sizes, your price)

TAM: $1.4B (Global, all company sizes, market average price)

Method 2: Top-Down (Use with Caution)

Start with industry data, narrow down.

Step 1: Find total industry size

Source: Gartner, Statista, IBISWorld, or industry reports.

Example: Global project management software market = $6.7B in 2026

Step 2: Filter by your segment

$6.7B x 30% (SMB segment) = $2B

$2B x 40% (US market) = $800M

$800M x 15% (cloud-native only) = $120M

Step 3: Apply competition filter

$120M x 25% (realistic capture rate) = $30M SOM

Method 3: Value-Based

Calculate based on the problem you solve.

Step 1: Quantify the pain

Example: "Companies waste 5 hours/week on manual reporting. At $50/hour average, that's $13,000/year per company."

Step 2: Count affected companies

Example: 200,000 companies in your target segment

Step 3: Apply willingness to pay

200,000 x $13,000 = $2.6B (theoretical value)

200,000 x $1,200/year (realistic price) = $240M SAM

Market Size Calculator: Quick Reference

| Your Price | 1,000 customers | 10,000 customers | 100,000 customers |

|---|---|---|---|

| $9/month | $108K ARR | $1.08M ARR | $10.8M ARR |

| $29/month | $348K ARR | $3.48M ARR | $34.8M ARR |

| $99/month | $1.19M ARR | $11.9M ARR | $119M ARR |

| $299/month | $3.59M ARR | $35.9M ARR | $359M ARR |

Find your realistic customer count. Multiply by your price. That's your SOM.

Free Tools to Calculate Market Size

| Tool | Best For | Cost |

|---|---|---|

| Statista | Industry-level TAM data | Free limited / $199/mo |

| Census Bureau | US business counts by size/industry | Free |

| LinkedIn Sales Navigator | Counting companies by segment | $99/mo |

| Crunchbase | Startup/tech company counts | Free limited |

| Google Trends | Demand trajectory | Free |

| TestYourIdea | Full market analysis + competitor count | Free |

What Investors Actually Want to See

Investors don't want big numbers. They want believable numbers.

Good market size slide:

TAM: $4.2B (Global HR software, Gartner 2026)

SAM: $840M (US mid-market, cloud-only)

SOM: $42M (Companies actively switching from legacy systems)

Bottom-up validation:

- 12,000 target companies (LinkedIn count)

- $299/month average price (competitor benchmark)

- 12,000 x $3,588 = $43M

Bad market size slide:

TAM: $50B (HR tech industry)

If we get 1% = $500M opportunity

The first shows work. The second shows you Googled "HR market size" and called it a day.

Market Size Red Flags

Watch for these in your own analysis:

"The market is $X billion"

Without segmentation, this is meaningless. Which billion? Where? Who?

"No direct competitors"

Then either the market doesn't exist, or you're not looking hard enough. Both are problems.

"We just need 1%"

The "1% of a big market" argument is a red flag for investors. It assumes distribution is free. It's not.

TAM equals SAM

If your TAM and SAM are the same number, you haven't done the work. Every business has constraints.

Market Size by Startup Type

| Startup Type | Typical SOM (Year 1-3) | Notes |

|---|---|---|

| B2B SaaS (SMB) | $1M - $20M | Easier to reach, lower prices |

| B2B SaaS (Enterprise) | $5M - $50M | Harder sales, bigger contracts |

| B2C Subscription | $500K - $10M | Volume play, high churn |

| Marketplace | $2M - $30M | Network effects matter |

| Developer Tools | $1M - $15M | Bottom-up adoption |

These are realistic Year 1-3 numbers for bootstrapped or seed-stage startups. Not VC fantasy math.

How to Validate Your Market Size

Numbers on paper mean nothing without validation.

1. Count real prospects

Build a list of 100 target companies. If you can't find 100, your market is too small or too vague.

2. Check competitor revenue

If the market leader does $50M ARR and there are 5 competitors, the market is probably $100-200M. Not $5B.

3. Talk to customers

Ask: "How much do you spend on [problem] today?" Their answers reveal willingness to pay.

4. Test demand

Run $100 in Google Ads. If nobody clicks on "[your solution] + software," the market might not exist.

5. Scan your idea

Get competitor counts, market signals, and demand data in 60 seconds.

Skip the manual research

We pull competitor counts, funding data, and market signals automatically. You get the numbers, with sources attached.

See what's in your market->Market Size Template

Copy this framework for your pitch deck:

MARKET OPPORTUNITY TAM: $[X]B [Source + year] Definition: [Who's included] SAM: $[X]M [Geographic/segment filter] Definition: [Your reachable market] SOM: $[X]M [Realistic capture] Definition: [What you can win in 3 years] Bottom-up validation: - [X] target companies (source) - $[X]/month price point (competitor benchmark) - [X]% realistic penetration - = $[X]M Year 3 opportunity

The Real Question

Market size isn't about impressing investors with big numbers.

It's about answering: "Is this opportunity worth my next 3-5 years?"

A $50M SOM with clear path to capture beats a $5B TAM you'll never touch.

Calculate honestly. Build accordingly.

Want to understand the full validation process beyond market sizing? Read our detailed TAM SAM SOM guide or our 5-step startup validation framework.

Frequently Asked Questions

How do I calculate TAM SAM SOM?

TAM (Total Addressable Market) is everyone who could buy your product globally. SAM (Serviceable Addressable Market) is the portion you can reach with your business model and geography. SOM (Serviceable Obtainable Market) is what you can realistically capture in 1-3 years. Calculate bottom-up: count target customers and multiply by your price.

What is a good market size for a startup?

For seed-stage startups, a SOM of $50M-500M is typically attractive to investors. Too small (under $10M) limits growth potential. Too large without clear segmentation suggests the founder hasn't done the work. The key is showing a credible path to capturing your slice.

How do you calculate market size for a new product?

Use bottom-up analysis: define your specific customer (industry, size, geography), count how many exist using LinkedIn or Census data, multiply by your price point. Validate by checking competitor revenue and talking to potential customers about current spending.

What's the difference between TAM and market opportunity?

TAM is theoretical (everyone who could buy). Market opportunity is practical (what you can actually capture). A $10B TAM with 50 entrenched competitors has less opportunity than a $500M TAM with one weak incumbent. Focus on SOM, not TAM.

How accurate are market size calculators?

Market size estimates are directionally accurate, not precise. Bottom-up calculations based on countable customers are more reliable than top-down industry reports. Always validate with real-world signals: competitor revenue, customer interviews, and demand testing.

What market size do VCs look for?

Most VCs targeting 10x returns need markets where a startup could reach $100M+ ARR. This typically means a SAM of $500M+ and SOM of $50M+. But market size alone doesn't determine investment. Team, timing, and traction matter equally or more.

How do I calculate market size if there's no existing data?

Look at adjacent budgets. If you're solving a problem companies currently handle with spreadsheets and interns, estimate how much that costs them annually. If you're replacing an existing tool, use that tool's pricing as your anchor. The market exists even when the reports don't.

Is there a market size template I can use?

The template above works for most pitch decks. For a working version with your actual numbers, run your idea through our analyzer — it generates TAM/SAM/SOM estimates with cited sources you can drop directly into your deck.

My market seems too small. Should I pivot?

Not necessarily. A $30M SOM can build a great business, just maybe not a venture-backed one. Be honest about what kind of company you're building. If you want VC money, you'll need to show a path to a bigger market (new segments, geographies, or products). If you're bootstrapping, a focused $30M market with weak competition might be exactly right.

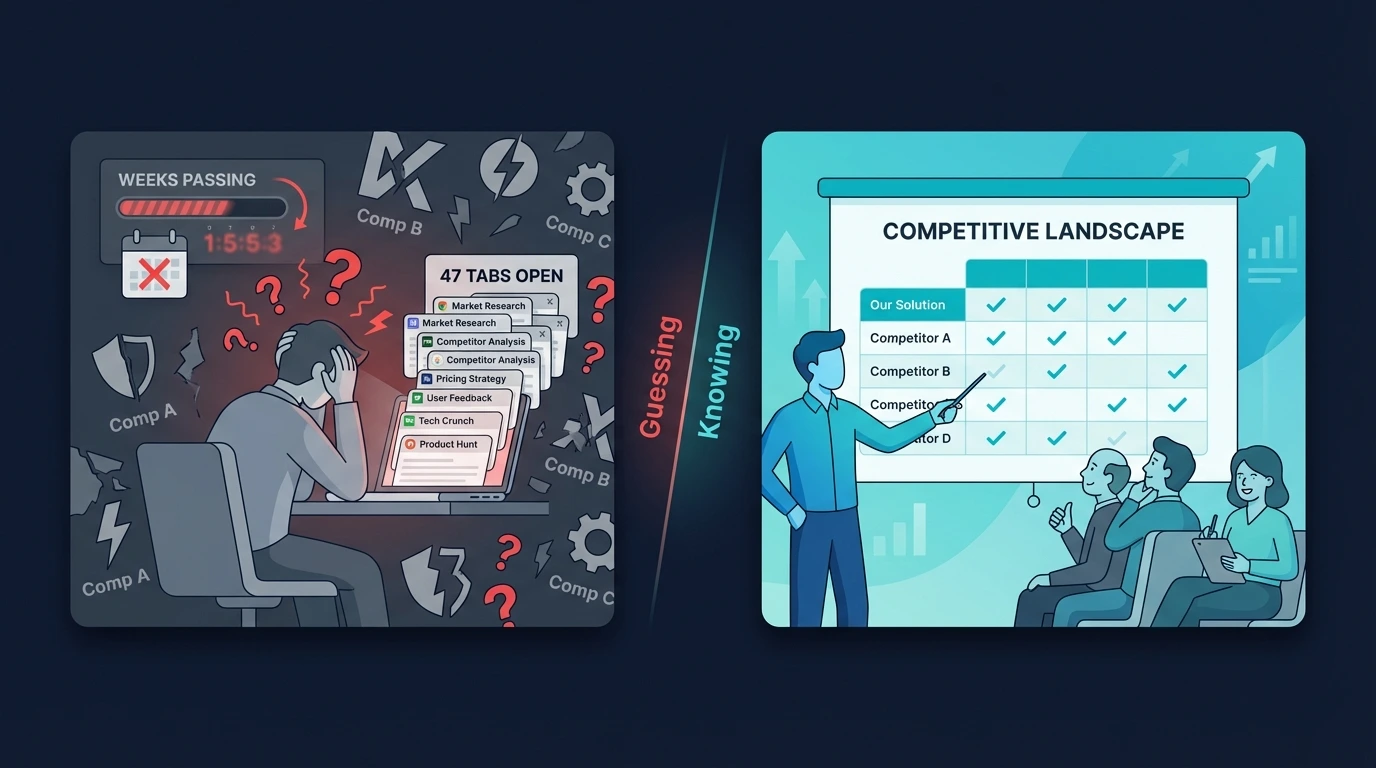

Stop Guessing Your Market Size

TestYourIdea pulls real market sizing, competitor funding data, and demand signals automatically. The data slide every investor asks for. With sources they'll actually believe.

Get Investor Data->Free preview. Full report $19. Used by founders preparing for pre-seed.