Competitor Analysis for Startups: What Actually Matters 2026

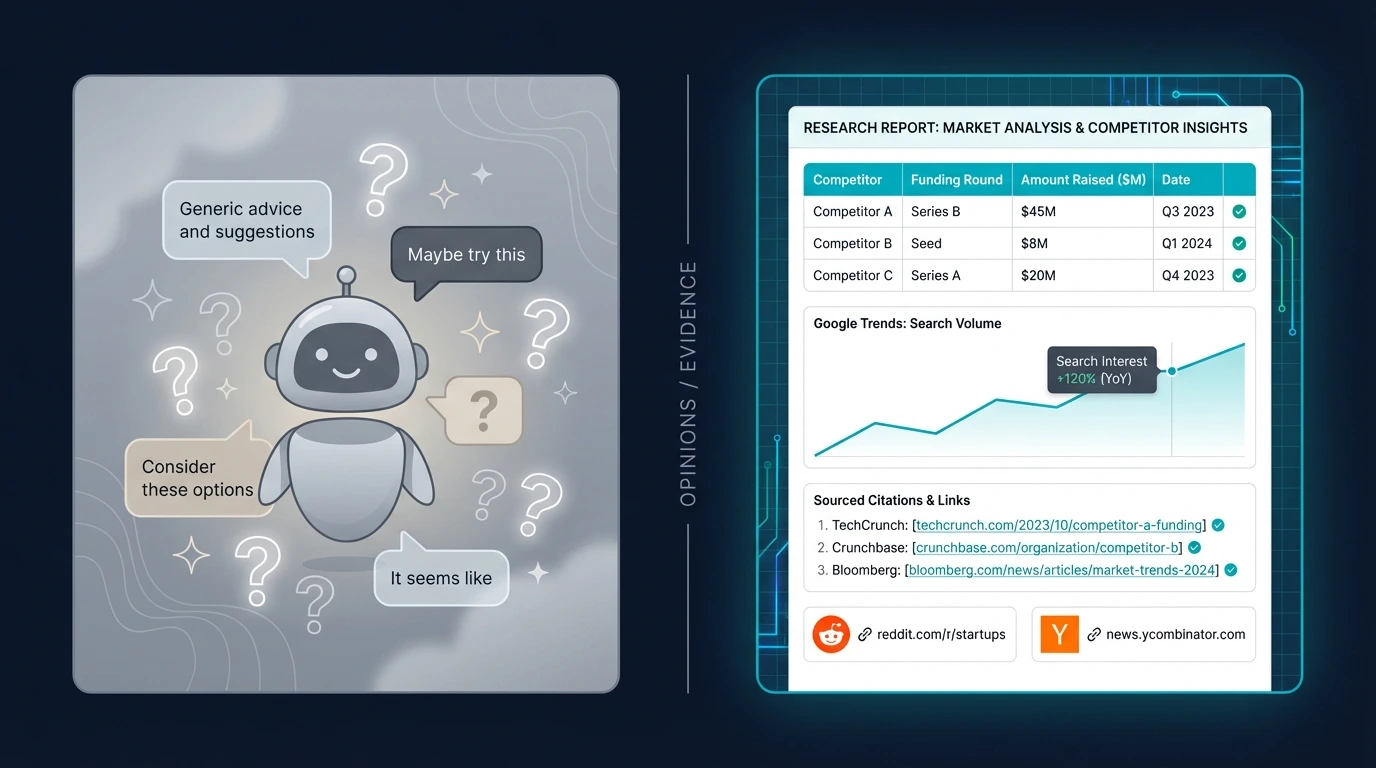

Skip the 50-page competitor reports. Here's what investors actually want to see and how to find competitor data that shapes your strategy.

"Who are your competitors?"

Every investor asks. Most founders answer wrong.

They either say "we have no competitors" (red flag) or dump a 50-page spreadsheet comparing 47 features across 12 tools (waste of time).

Neither helps you build a better product or raise money.

Here's what actually matters in competitor analysis, and how to do it in an afternoon.

Why "No Competitors" Is a Red Flag

Founders love saying "nobody else does what we do."

Investors hear: "I haven't done my research" or "the market doesn't exist."

Every startup has competitors. If not direct, then indirect. If people have a problem, they're solving it somehow. That "somehow" is your competition.

The rule: Competitors validate your market. No competitors = no market. Too many competitors = saturated market. 3-10 competitors with clear gaps = opportunity.

The Two Types of Competitors

Direct Competitors

Same solution, same customer, same problem.

If you're building a CRM for real estate agents, your direct competitors are other CRMs for real estate agents. Not Salesforce. Not HubSpot. The specific tools your exact customer evaluates.

Indirect Competitors

Different solution, same problem.

For that real estate CRM, indirect competitors include: spreadsheets, paper notebooks, generic CRMs adapted for real estate, virtual assistants who manage contacts manually.

Indirect competitors matter because they show how people currently solve the problem. Your job is to be better than their current workaround.

What Investors Actually Want to See

Not a feature matrix. Not a SWOT analysis from business school.

Investors want answers to three questions:

- 1.Who else is solving this? Prove you know the landscape.

- 2.Why will you win? What's your unfair advantage?

- 3.What happens when they copy you? Is your moat defensible?

That's it. Everything else is noise.

The 5 Data Points That Matter

For each competitor, collect these five things. Nothing more.

1. Funding & Stage

How much have they raised? From whom? When?

Why it matters: A competitor with $50M in funding is a different threat than a bootstrapped solo founder. Funded competitors validate the market but also mean you're fighting well-armed opponents.

Where to find it: Crunchbase, PitchBook, company press releases, LinkedIn announcements.

2. Pricing

What do they charge? What's included at each tier?

Why it matters: Pricing reveals positioning. High prices = enterprise focus. Low prices = volume play. Free tier = growth-at-all-costs. This shapes your own pricing strategy.

Where to find it: Their website (pricing page), G2, Capterra, or just sign up for their product.

3. Customer Reviews

What do customers love? What do they hate?

Why it matters: Reviews are free customer research. The complaints show gaps you can fill. The praise shows what's table stakes.

Where to find it: G2, Capterra, Product Hunt, App Store, Reddit, Twitter.

Pro tip: Sort reviews by "most critical" first. The 1-star and 2-star reviews tell you exactly what's broken. Build the thing they wish existed.

4. Target Customer

Who are they selling to? SMB? Enterprise? Specific vertical?

Why it matters: You don't have to compete head-to-head. If all competitors target enterprise, there might be an underserved SMB segment. If everyone's horizontal, go vertical.

Where to find it: Their homepage copy, case studies, customer logos, LinkedIn job postings (who are they hiring to sell to?).

5. Key Weakness

What's the one thing they're bad at that you can own?

Why it matters: This is your angle. Your positioning. The reason customers will switch. If you can't name a weakness, you don't have a strategy.

Where to find it: Reviews (complaints), Reddit threads, Twitter rants, churned customer interviews.

The Competitor Analysis Template

One row per competitor. Five columns. That's it.

| Competitor | Funding | Pricing | Target | Weakness |

|---|---|---|---|---|

| Competitor A | $12M Series A | $99-299/mo | Mid-market | Clunky UX, slow support |

| Competitor B | Bootstrapped | $29/mo flat | SMB | Missing integrations |

| Competitor C | $45M Series B | Enterprise only | Fortune 500 | Overkill for small teams |

| Spreadsheets | N/A | Free | Everyone | Manual, error-prone |

This fits on one pitch deck slide. Investors can scan it in 10 seconds. That's the point.

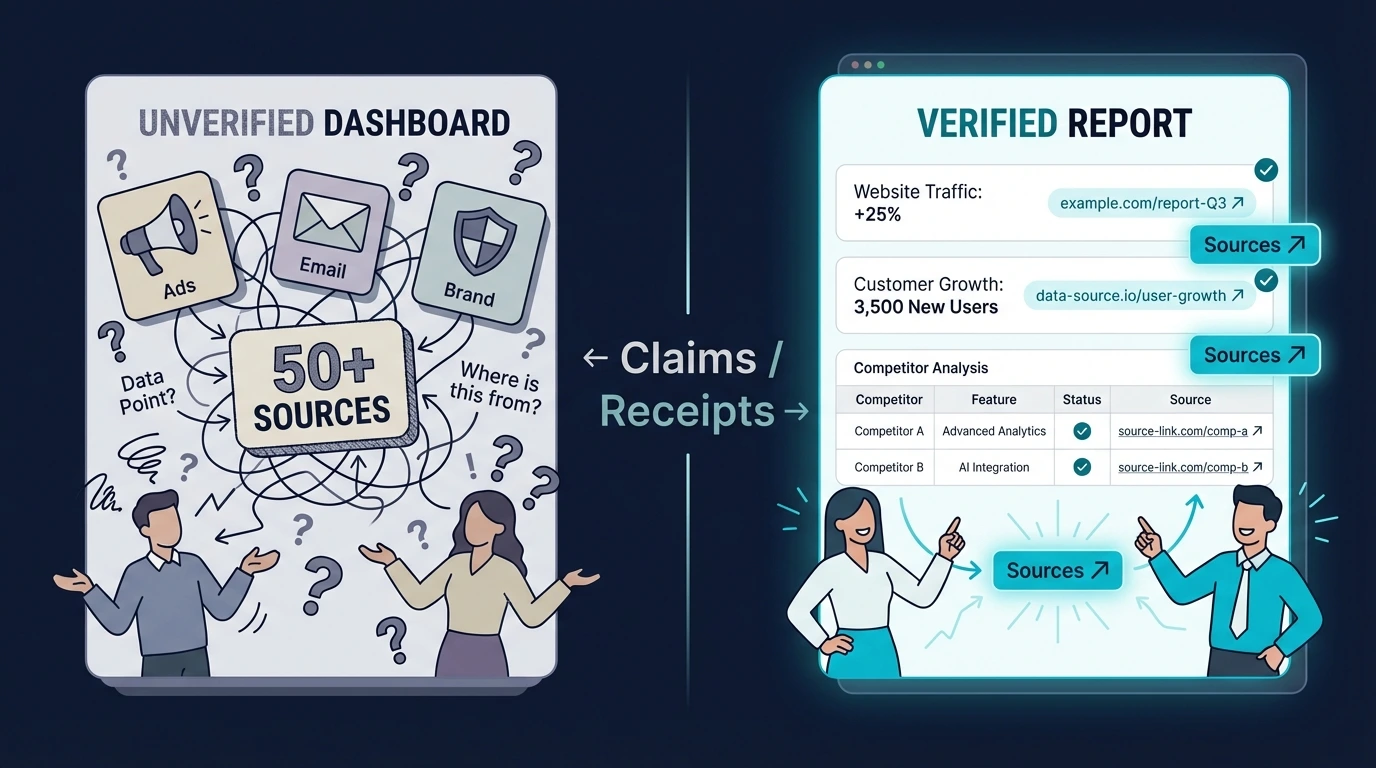

How to Find Competitors You Don't Know About

The competitors you know are obvious. The ones you don't know will blindside you.

Search Strategies

- •Google: "[problem] software", "[problem] tool", "[problem] app", "best [solution] for [customer]"

- •G2/Capterra: Browse categories, check "alternatives to [known competitor]"

- •Product Hunt: Search your category, sort by upvotes

- •Crunchbase: Find one competitor, check "similar companies"

- •Reddit: "What do you use for [problem]?" in relevant subreddits

The Customer Interview Hack

Ask potential customers: "What have you tried before? What do you use now?"

They'll name competitors you've never heard of. They'll mention workarounds you didn't consider. This is gold.

Get competitor data in 60 seconds

We scan 20+ sources to find your competitors, their funding, and the gaps you can own.

Analyze my competitors →Turning Analysis Into Strategy

Data without action is useless. Here's how to use what you found.

Find Your Angle

Look at the weaknesses column. Which one can you own?

- •All competitors have clunky UX → You're the "simple" option

- •All competitors target enterprise → You're the SMB play

- •All competitors are horizontal → You go vertical (niche)

- •All competitors are expensive → You're the affordable option

Pick one angle. Own it completely. Don't try to be everything.

Set Your Pricing

Competitor pricing is your benchmark. You have three options:

- 1.Price lower: Compete on value. Risk: race to bottom.

- 2.Price similar: Compete on features/experience. Risk: need clear differentiation.

- 3.Price higher: Compete on premium positioning. Risk: need to justify the premium.

Steal Their Customers

Reviews tell you exactly what frustrated customers want. Build that. Then target those customers directly.

Tactics that work:

- •SEO for "[competitor] alternative"

- •Comparison landing pages

- •Reply to complaint tweets with your solution

- •Build the integration they're missing

- •Offer migration from competitor

Competitor Analysis Mistakes

Avoid these common traps:

- ✗"We have no competitors" — You do. Find them.

- ✗50-feature comparison matrix — Nobody reads these. Focus on what matters.

- ✗Ignoring indirect competitors — Spreadsheets and manual processes are competitors too.

- ✗One-time analysis — Competitors evolve. Review quarterly.

- ✗Obsessing over competitors — Awareness is good. Paranoia is paralyzing.

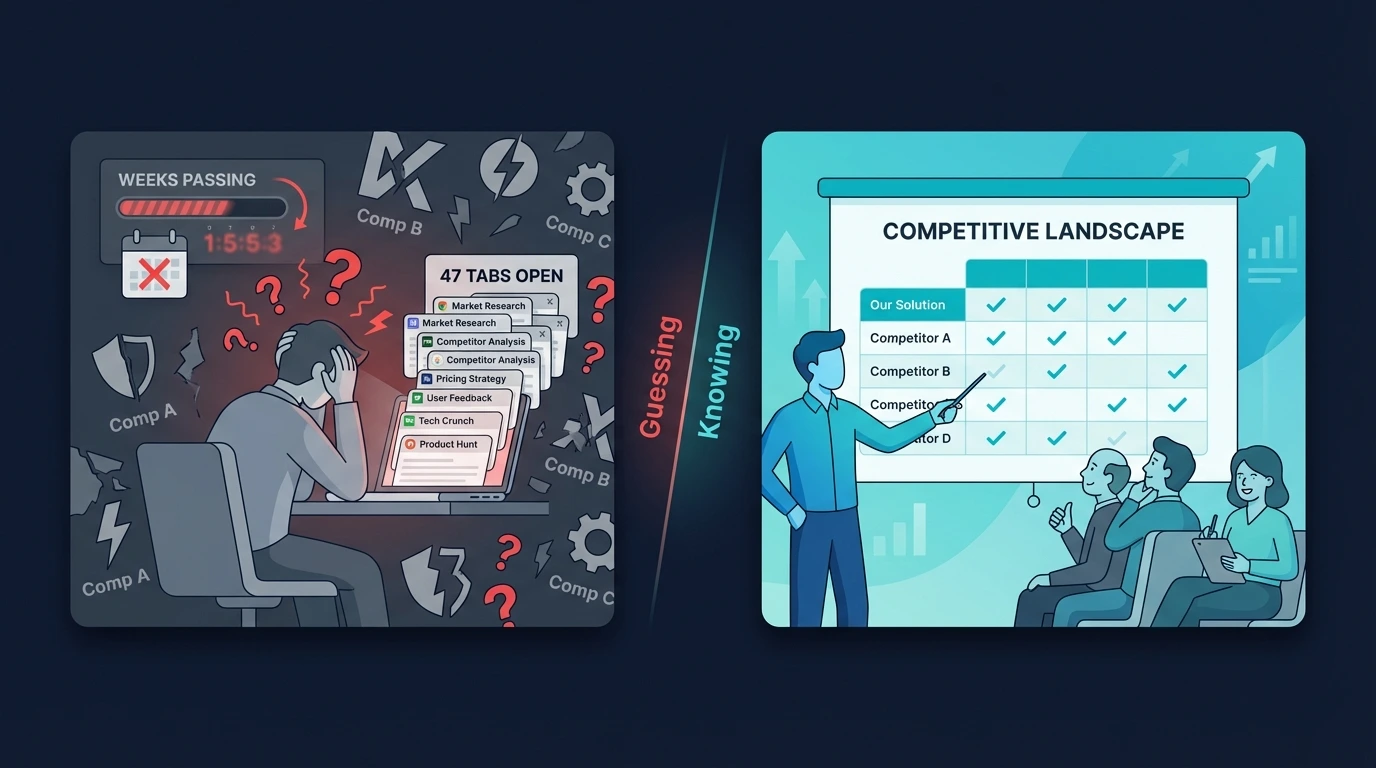

The Pitch Deck Competitive Slide

Every pitch deck needs a competitive slide. Here's the format that works:

COMPETITIVE LANDSCAPE

[2x2 matrix or simple table]

│ Feature A │ Feature B

─────────┼──────────────┼──────────────

Us │ ✓ Best │ ✓ Yes

Comp A │ ✗ No │ ~ Partial

Comp B │ ~ Partial │ ✓ Yes

Comp C │ ✓ Yes │ ✗ No

WHY WE WIN:

"We're the only [solution] built specifically for

[customer] who need [key differentiator]."

Keep it to one slide. If you can't explain your advantage in one slide, you don't have one.

How Often to Update

- •Before fundraising: Full refresh

- •Quarterly: Quick scan for new entrants, funding news, pricing changes

- •When a competitor raises: Assess impact on your positioning

- •When you lose a deal: Find out who you lost to and why

Set a calendar reminder. Competitive intelligence decays fast.

Stop Googling. Start knowing.

Get competitor funding, pricing, and gaps in 60 seconds. Data from 20+ sources.

Run competitor analysis →Frequently Asked Questions

How many competitors should I analyze?

3-5 direct competitors and 2-3 indirect competitors. More than that creates noise without insight. Focus on the ones your customers actually consider.

What if my competitors are much bigger than me?

Big competitors are slow. They can't serve niches well. They have legacy code and enterprise bloat. Find the segment they're ignoring and own it completely.

Should I mention competitors by name in my pitch?

Yes. Investors know them anyway. Naming competitors shows you've done your homework. Just don't trash-talk. State facts: what they do, what they don't, why you're different.

What if a competitor copies my feature?

They will. Features aren't moats. Your moat is speed of execution, customer relationships, brand, network effects, or proprietary data. Build something that's hard to copy, not just a feature.

How do I find competitor revenue?

Most don't publish it. Estimate from employee count (roughly $150-200K revenue per employee for SaaS), funding amounts, or third-party estimates on Growjo, Latka, or SimilarWeb traffic data.

Is it worth paying for competitive intelligence tools?

At early stage, no. Free tools (Crunchbase, G2, Google) give you 80% of what you need. Paid tools like Crayon or Klue make sense when you have a sales team that needs real-time intel.