How to Research Your Pitch Deck (Data Investors Actually Want)

Investors reject 99% of pitch decks. Usually it's the market slide. Here's how to get the data that survives due diligence.

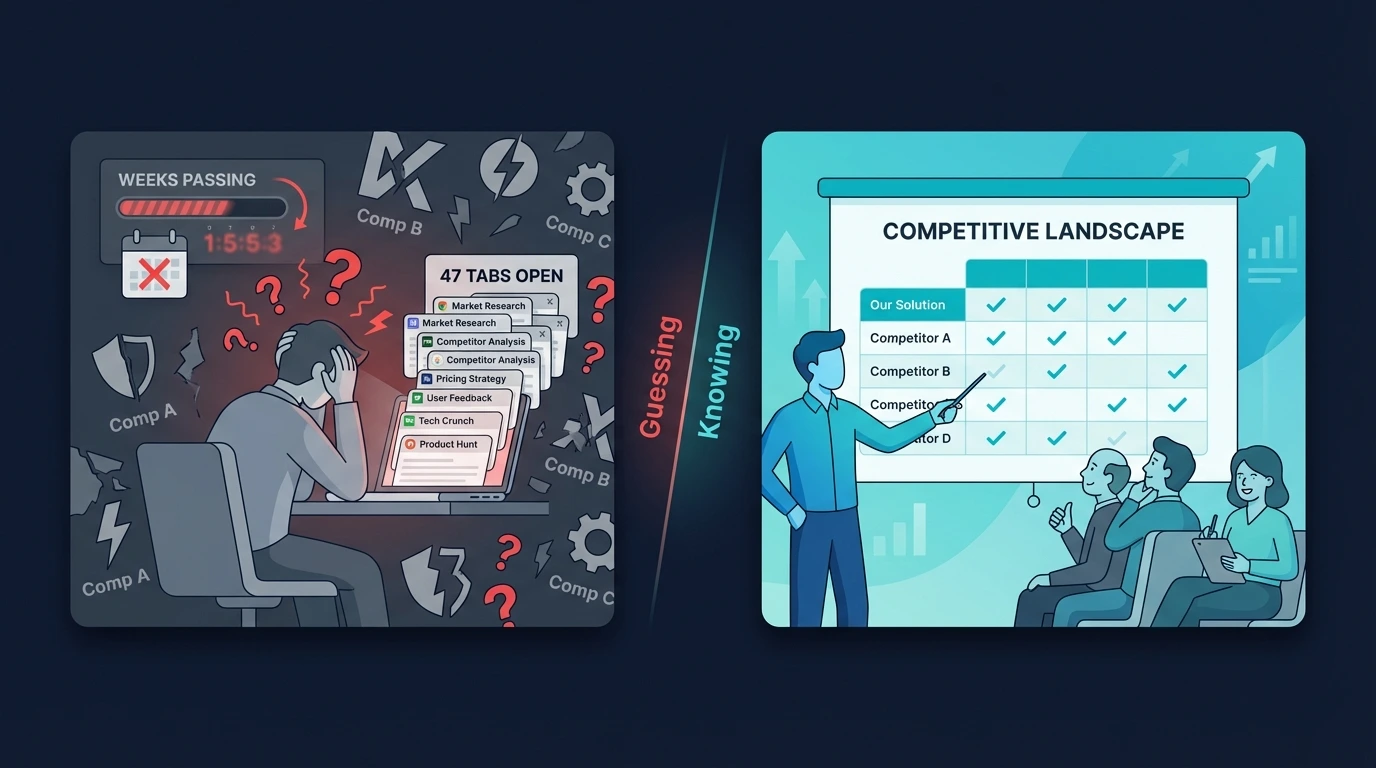

Investors see thousands of pitch decks. They reject 99% of them.

The rejection usually happens in the first 60 seconds. And it's almost never because the idea is bad.

It's because the data is weak.

"The market is $50 billion" with no source. Competitor slide missing the obvious player. Financial projections that assume 10% conversion rates. TAM numbers copy-pasted from a Google search.

Investors spot this instantly. They've seen it a thousand times.

Here's how to research your pitch deck so it survives the first minute.

The Slides That Kill Decks

Not all slides are equal. Three slides get the most scrutiny:

1. Market Size Slide

What investors look for: TAM, SAM, SOM with clear methodology and sources. Bottom-up math, not top-down fantasy.

What kills you: "The global X market is $100B" with a random Statista link. No breakdown. No explanation of how you'll capture any of it.

Red flag: "If we get just 1% of the market..." Investors have heard this line 10,000 times. It shows you don't understand how hard 1% actually is.

2. Competition Slide

What investors look for: Awareness of the landscape. Direct and indirect competitors. Your differentiation.

What kills you: "We have no competitors." Or a 2x2 matrix where you're magically in the top-right quadrant and everyone else is bottom-left.

3. Financials Slide

What investors look for: Realistic projections based on stated assumptions. Unit economics that make sense. A path to the numbers.

What kills you: Hockey stick projections with no explanation. $10M ARR in Year 2 with a $29/month product and no distribution strategy.

The Research Investors Expect

For a credible pitch deck, you need data in five areas:

| Area | What You Need | Time (DIY) |

|---|---|---|

| Market Size | TAM/SAM/SOM with sources, bottom-up validation | 4-6 hours |

| Competitors | 5-10 competitors, funding, pricing, weaknesses | 3-5 hours |

| Customer | ICP definition, pain points, willingness to pay | 5-10 hours |

| Unit Economics | CAC, LTV, margins, payback period | 2-4 hours |

| Financial Model | 3-year projections with assumptions | 6-10 hours |

Total: 20-35 hours of research. That's before you design a single slide.

Most founders skip this. They Google for an hour, make up the rest, and wonder why investors pass.

How to Research Market Size (Without Making It Up)

The market slide is where most decks fall apart. Here's how to do it right.

Bottom-Up Method (What Investors Want)

Start with your customer, not the industry.

Step 1: Define your customer

"B2B SaaS companies with 10-50 employees in the US"

Step 2: Count them

47,000 companies (source: Census Bureau + LinkedIn)

Step 3: Multiply by your price

47,000 × $99/month × 12 = $55.8M

Step 4: That's your SOM (realistic Year 1-3 market)

Step 5: Scale up for SAM and TAM

SAM: All company sizes in US = $280M

TAM: Global = $1.4BThis is defensible. You can explain every number. Investors respect this.

Top-Down Method (Use as Validation Only)

Start with industry reports, narrow down.

Global HR software market: $24B (Gartner 2025)

× 15% SMB segment = $3.6B

× 40% North America = $1.44B

× 10% your niche = $144M SAMTop-down is fine for context. But if your bottom-up and top-down numbers don't roughly match, something's wrong.

How to Research Competitors (Without Missing the Obvious)

The competitor slide needs to answer three questions:

- 1.Who else is solving this problem?

- 2.Why will you win against them?

- 3.What happens when they copy you?

Where to find competitors:

- •G2, Capterra (search your category)

- •Crunchbase (find one, check "similar companies")

- •Google "[problem] software" or "[solution] tool"

- •Reddit "what do you use for [problem]"

- •Ask potential customers what they've tried

Data to collect per competitor:

- •Funding raised (Crunchbase)

- •Pricing (their website)

- •Target customer (their homepage copy)

- •Key weakness (G2 reviews, 1-star complaints)

Pro tip: Don't forget indirect competitors. Spreadsheets, manual processes, and "doing nothing" are competitors too. They show how people solve the problem today.

The Financial Model Trap

Investors don't expect you to predict the future. They expect you to think clearly about it.

What they're checking:

- •Are your assumptions stated clearly?

- •Do the unit economics make sense?

- •Is there a logical path from here to there?

- •Do you understand your own numbers?

Red flags in financial models:

- ✗Revenue grows 10x but costs stay flat

- ✗No customer acquisition cost included

- ✗100% month-over-month growth sustained for years

- ✗Conversion rates above industry benchmarks with no explanation

Three Ways to Get Pitch Deck Research Done

| Option | Cost | Time | Quality |

|---|---|---|---|

| DIY Research | Free | 20-35 hours | Depends on your skills |

| Hire Consultant | $3,000-10,000 | 2-4 weeks | Variable |

| TestYourIdea | $19-499 | Minutes | 20 data sources |

What You Get at Each Level

Free Scan: Quick score to see if your idea has legs.

Founder Report ($19): Full competitor analysis, market size with sources, blockers with fixes, Niche Coach to find your angle, Investment Memo POV analyzed like a VC would.

Investor Package ($499): Everything in Founder Report plus 19-slide pitch deck, investment memo PDF, financial model in Excel, and due diligence checklist. Skip 20+ hours. Get investor-ready.

Stop Googling for market data

Get the research investors actually want. 20 data sources. 60 seconds.

Research my pitch deck →What's in the 19-Slide Pitch Deck

Not a template. Fully structured with investor-grade content generated from your idea's data:

| # | Slide | What's Included |

|---|---|---|

| 1 | Title | Company name, one-liner, positioning |

| 2 | Traction Teaser | Key metrics upfront (if impressive) |

| 3 | Problem | 3-4 data-backed pain points |

| 4 | Solution | Mirrors problem structure |

| 5 | Market Validation | Evidence the market exists |

| 6 | Why Now | Market catalysts, timing |

| 7 | Target Audience | ICP deep dive |

| 8 | Market Size | Bottom-up TAM/SAM/SOM with sources |

| 9 | Product | 3-4 step product flow |

| 10 | Roadmap | Now → Q2 → Q4 → 2027 |

| 11 | Business Model | 3-tier pricing, unit economics |

| 12 | Go-to-Market | Full acquisition funnel |

| 13 | Traction | Validation evidence |

| 14 | Competition | 2x2 matrix positioning |

| 15 | Defensibility | Moat analysis |

| 16 | Team | Required strengths, key hires |

| 17 | Risks | Top concerns + mitigations |

| 18 | Financials | 5-year projections |

| 19 | The Ask | Round size, use of funds, milestones |

Plus appendix with 3 elevator pitch variations, investor Q&A prep, and all sources cited.

What's in the Financial Model

Excel workbook with 5 tabs. All numbers derived from your idea's data:

| Tab | What's Included |

|---|---|

| Summary Dashboard | Key metrics grid, unit economics overview |

| Revenue Model | Year 1-5 revenue, customers, ARPU, MRR, growth % |

| Unit Economics | CAC, LTV, LTV:CAC ratio, payback period, margins, churn, NRR |

| Burn & Runway | Cash flow projections, break-even year, runway in months |

| Assumptions | Growth rates, margin assumptions, key risks |

Investors will ask for this. Have it ready before the first meeting.

The Pitch Deck Research Checklist

Before you send your deck, verify you have:

- ☐TAM/SAM/SOM with sources and methodology

- ☐Bottom-up market size calculation

- ☐5-10 competitors identified (direct + indirect)

- ☐Competitor funding and pricing data

- ☐Clear differentiation / why you win

- ☐ICP defined with specifics (not "small businesses")

- ☐Unit economics: CAC, LTV, margins

- ☐Financial projections with stated assumptions

- ☐Every number can be explained if asked

If you can check all nine boxes, your deck is stronger than 90% of what investors see.

Frequently Asked Questions

How much market research do I need for a pitch deck?

Enough to answer any follow-up question. At minimum: market size with sources, 5+ competitors with funding/pricing, and unit economics. If an investor asks "where did this number come from?" you need an answer.

What sources do investors trust for market data?

Gartner, Statista, IBISWorld for industry data. Census Bureau for customer counts. Crunchbase for competitor funding. Your own bottom-up calculation is often most credible because you can explain every assumption.

Should I include competitors who are much bigger than me?

Yes. Investors will ask about them anyway. Big competitors validate the market. Your job is to explain why you'll win a segment they can't serve well.

How far out should financial projections go?

3 years is standard for seed stage. 5 years for Series A+. Year 1 should be detailed. Year 3 can be directional. Nobody believes Year 5 anyway.

What if I can't find market size data for my niche?

Build it bottom-up. Count your target customers (LinkedIn, industry associations, Census data). Multiply by your price. That's more credible than forcing a top-down number that doesn't fit.

Do I need a financial model for pre-seed?

A simple one. Unit economics, basic 3-year projections, stated assumptions. You don't need 50 tabs. You need to show you understand the math of your business.

Ready to raise?

Founder Report ($19) for the data. Investor Package ($499) for pitch deck, financial model, and investment memo.

Start my research →